Workshop on Money Professionals in Paris

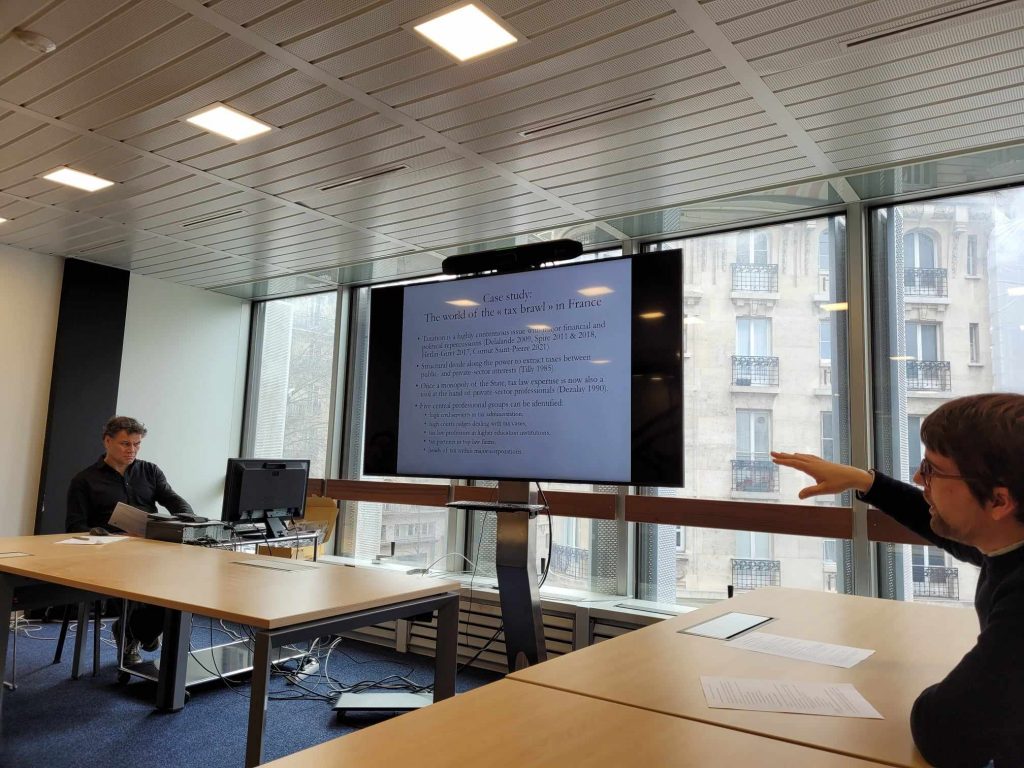

The TAXLAW team organised a paper workshop on Money Professionals at the Centre Universitaire Norvégien de Paris/Maison des sciences de l’homme in Paris, France, from March 11th to 13th.

Over the past few years, we have buildt a network of researchers whose work inspires us and who we believe can develop new insights and promising research avenues by discussing their work within the framework of the topic Money Professionals. These researchers come from a range of fields and use different theoretical and methodological approaches. However, they share a commonality in contributing new insights into the roles and influence of professionals or experts who work with money.

We held our first workshop on Money Professionals in Paris in June 2022, and another in Oslo in October 2022. This year, we followed up with a new workshop in Paris to consolidate and expand our network.

In addition to the TAXLAW team members Marte Mangset, Len Seabrooke, Jérôme Pélisse, Corentin Durand, Helle Dyrendahl Staven, and Jakob Laage-Thomasen, the workshop participants included Lola Avril (School of Law, University of Eastern Finland), Johan Christensen (Institute of Public Administration, Leiden University), Maj Grasten (Department of Business Humanities and Law, Copenhagen Business School), Benjamin Lemoine (Centre Maurice Halbwachs, CNRS), Saila Stausholm (Max Planck Institute for the Study of Societies), Alexandra Bahary-Dionne (Centre de sociologie des organisations, Sciences Po), Antoine Costes (IDHES, Nanterre University), and Nathan Darras (IDHES, Nanterre University).

Studies presented at the workshop fell under the themes of legal expertise and political influence, the interface of legal expertise between the state and the market, and professional networks. These were both work in progress and more finished texts, with a variation of theoretical perspectives and a variety of data.

From the TAXLAW team, Helle and Marte presented a paper on the autonomy and authority of academic expertise in the field of tax law. Marte and Len presented a work in progress on the revolving doors phenomenon in French tax law, while Jérôme and Corentin presented a paper on neutral spaces.

The workshop was a beneficial experience, facilitating meaningful exchanges on the research topic of money professionals. The participants, coming from varied perspectives, contributed to useful discussions that aided in the development of our collective research. Overall, the workshop was an engaging event that supported our ongoing study in this important area.