“There is a growing global consensus that the secrecy -havens -jurisdictions which undermine global standards for corporate and financial transparency – pose a global problem: they facilitate both money laundering and tax avoidance and evasion, contributing to crime and unacceptable high levels of global wealth inequality”

Joseph E. Stiglitz and Mark Pieth

We seek to encourage investigative journalists and others to collaborate across borders to critically examine transparency in financial markets, economics, law and practice.

Understanding the phenomenon of illicit financial flows requires input from several disciplines including law, finance, accounting and economics. However, much of what is known about illicit financial flows is thanks to whistle-blowers, civil society organisations and investigative journalists.

The course

In this course, you will learn about complex financial data, interpreting the economy of transactions, understand more about why and how legal frameworks may or may not deal with secrecy mechanisms, and understand more about aggressive tax planning, tax evasions, law, accounting and journalism and explore how to interpret and understand complex information on finance and financial transactions, including the workings of intricate global networks of businesses and webs of ownerships, including those registered in tax havens.

This is important for our societies because each year local and national economies throughout the world lose billions of dollars through so-called illicit financial flows. Conservative estimates indicate that over a billion dollars are diverted illegitimately out of countries in the Southern Hemisphere every year. This diversion of revenue reinforces poverty while facilitating the concentration of power in the hands of a select few through corruption and abuse of authority. This is a hinder for a democratic development.

The course material include:

Filmed lectures from a series of research conferences called “Making Transparency Possible”, financed by the The Research Council of Norway.

Speakers at these conferences included scholars from Columbia University, Cardiff University, Newcastle University Business School, Sheffield University Management School, the Norwegian School of Economics (NHH), the University of Oslo, Oslo Metropolitan University (Oslo Met), Norwegian University of Life Sciences (NMBU), and representatives from the Norwegian National Authority for Investigation and Prosecution of Economic and Environmental Crime (Økokrim), the Directorate of Taxes (Skattedirektoratet), Finance Norway (Finans Norge) the Norwegian Organisation for International Development (Norad), the International Commission Against Impunity in Guatemala, (CICIG), professional accountants, whistle blowers, Norwegian union organisations, Norwegian civil society organisations. Also, investigative journalists from all over the world have shared their knowledge of how they have cooperated trans-nationally in large in-depth, cross country cases. Their work have often intertwined with large leaks such as the Panama Papers, Lux Leaks, and Swiss Leaks.

Interviews with renowned experts, academics and journalists on transparency in the financial markets, economist, law and practice highlighting the connection between investments, social conflict and democratic control over finance and resources, financed by Finansmarkedsfondet.

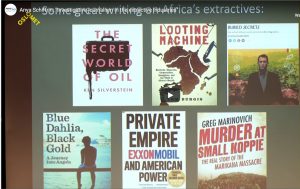

Fimes lectures from Amélie Lefebvre, Mar Cabra and Anya Schiffrin among many others.

This course is open for all. At the same time, this course is also integrated with Oslo Met’s master in Investigative Journalism, where anyone who has finished a Bachelor’s degree with an average grade of C or better are able to sign up for the course with assignments and exams.

LINK to course:

https://bokskapet.oslomet.no/courses/course-v1:BOKSKAPET+1825+1/info